An Unbiased View of Offshore Trust Services

Wiki Article

Offshore Trust Services Things To Know Before You Buy

Table of ContentsSome Known Questions About Offshore Trust Services.A Biased View of Offshore Trust ServicesFascination About Offshore Trust ServicesWhat Does Offshore Trust Services Mean?Offshore Trust Services Fundamentals Explained

Even if a financial institution can bring an illegal transfer case, it is difficult to prosper. They have to show beyond a practical doubt that the transfer was made with the intent to defraud that specific creditor and also that the transfer left the borrower bankrupt. Many overseas possession defense prepares include more than one legal entity.

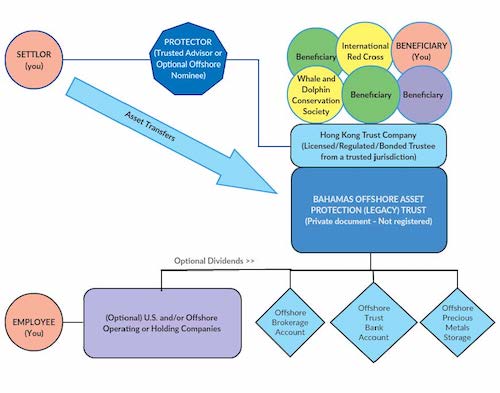

homeowner can establish an overseas count on as well as an U.S. restricted partnership or an offshore minimal responsibility business. Many overseas LLCs are created in Nevis, which for some time has been a popular LLC jurisdiction. Recent adjustments to Nevis tax obligation and declaring demands have led to LLCs in the Cook Islands.

person might develop a Nevis LLC and also move their organization rate of interests and also liquid assets to the LLC. The individual could next off develop a Cook Islands trust fund making use of an overseas trust company as a trustee. The LLC concerns subscription interests to the trustee of the Cook Islands count on. The Cook Islands depend on would certainly own 100% of the Nevis LLC.

With this kind of overseas trust framework, the Nevis LLC is taken care of by the United state individual when there are no expected claims. As soon as a lawful concern emerges, the trustee of the overseas trust fund need to eliminate the United state

Offer all required papers for the trustee's due persistance. Prepare the offshore count on paper with your attorney. Fund the trust by transferring domestic properties to the offshore accounts. The primary step to developing an offshore trust is selecting a count on territory. offshore trust services. In our experience, the Chef Islands supplies the very best combination of trustee guideline, favorable borrower legislations, as well as positive lawsuits outcomes contrasted to various other territories.

The trustee firm will use software program to validate your identification as well as examine your present legal situation in the united state Trust fund firms do not desire clients who might include the business in investigations or lawsuits, such as conflicts including the united state government. You must divulge pending lawsuits as well as examinations as part of the history check.

Getting The Offshore Trust Services To Work

Your residential asset security lawyer will certainly function with the overseas trustee firm to draft the overseas count on arrangement. The trust contract can be tailored based on your asset protection as well as estate preparation objectives.

accounting companies, and they use the audit results and their insurance coverage certifications to useful link potential offshore trust customers. Many individuals wish to maintain control of their own properties kept in their overseas trust by having the power to eliminate and also change the Recommended Reading trustee. Keeping the power to transform an offshore trustee creates lawful risks.

Overseas count on property defense works best if the trustmaker has no control over trust fund properties or other events to the trust. Some trustee companies allow the trustmaker to book primary discernment over count on investments and also account administration in the setting of trust consultant.

The trustmaker does not have straight access to overseas trust fund economic accounts, however they can request distributions from the overseas trustee The opportunity of turn over orders and civil contempt costs is a significant danger in offshore asset protection. Debtors counting on overseas trusts should consider the possibility of a residential court order to restore assets moved to a debtor's overseas depend on.

In instances when a court orders a debtor to loosen up an offshore count on plan, the debtor can claim that compliance is difficult because the depend on is under the control of an overseas trustee. Some recent court decisions deal with a transfer of properties to an offshore trust fund as a willful act of producing an click now impossibility.

The debtor had actually transferred over $7 million to an overseas trustee. The trustee after that moved the exact same cash to an international LLC of which the debtor was the sole member.

Not known Factual Statements About Offshore Trust Services

The overseas trustee declined, and also he stated that the money had actually been invested in the LLC (offshore trust services). The court held the borrower in contempt of court. The court discovered that in spite of the rejection by the offshore trustee, the borrower still had the capacity to access the funds as the sole member of the LLC.Report this wiki page